2024 Trading review and thoughts on coaching

My journey back into the markets began in June of this year. After a hiatus, I decided to give trading another try, and I’m incredibly glad that I did. For the first time, I sought help beyond free online resources, and I found a trading coach. I had always been hesitant to spend money on my trading journey, but the investment in hiring a coach has forever changed my perspective.

As an avid listener of the AlphaMind Podcast, I decided this would be my first step in finding a trading coach. After reading Steven Goldstein’s incredible new book, Mastering the Mental Game of Trading, which I found to be one of the best trading books I’ve ever read, I reached out to him on LinkedIn. He directed me to his co-host, Mark Randall, and the rest is history.

After my first few sessions with Mark, we honed in on where I could potentially fit within the trading world. One of my biggest challenges was identifying the environment, time, and style that aligned with who I was and suited my lifestyle. This led me to the way I trade today, broadened my perspective on the market, and changed my trading trajectory. It not only connects to my trading style but also to my role and purpose as a trader.

A key part of this journey involved leaving my comfort zone and stepping into the public world of trading, both through this blog and by reaching out to others in the finance and trading space. Mark emphasised the importance of becoming comfortable with discomfort, which significantly boosted my confidence and ability to hold my own in market-related conversations and situations.

Having read many trading books and watched countless videos, I’ve realised there’s something uniquely impactful about discussing your trading ideas and thoughts with a market veteran and coach. When I shared my ideas with Mark, had them challenged, and expanded upon, it unlocked a deeper and more lasting experience for me.

In addition to helping me align my targets for where I want to fit in as a trader in future, these discussions emphasised the importance of a process-driven and growth-oriented mindset while also touching on mindfulness and meditation. I have attempted trading many times over the years, but this time feels different. My approach is far more structured, my review process is significantly more detailed, and I now take both my trading work and the time it requires much more seriously. This shift required a fundamental change in my mindset, which I attribute to my exposure to a trading coach.

For now, my coaching sessions are complete, but I’ve come to appreciate sincerely their positive and transformative impact. I look forward to revisiting them when the time is right.

Now, it’s time to reflect on my trading performance over the past six months and wrap up my review of 2024.

The purpose of this blog was to help me discover my trading edge and refine how I should approach the markets, taking into account who I am and my personal preferences. At this stage, I would describe myself as a rules-based discretionary trader who uses price action methods to identify opportunities in the market. I am steadily honing my skills as the months go by and aim to continually enhance the methods and intuition I rely on.

After my conversations with Mark, one of my original goals, following many years of negative performance, was simply to finish the year at breakeven and halt the downward trend. And I am very proud to say that for the first time since beginning my trading journey years ago, I’ve finally ended the year in the green! 🚀

A key component of my review and analysis is my trading journal and log. I used to believe that maintaining a trading journal was unnecessary and too much effort, but I could not have been more wrong. Keeping a detailed record of all my trades, including their metrics, performance, my thoughts on each trade, and various tracked parameters, has provided me with a vast, personalised dataset.

Coming from an engineering and analytical background, I’ve found that the more data, the better – and this principle holds true in trading. Admittedly, I may have taken it to extremes: my trading journal currently contains 85 columns in a Google Sheet format (😂). While many of these are calculated fields, a significant number require manual inputs for each trade. I’ll spare the detailed breakdown of the sheet for a later post, but it has definitely evolved and expanded over time, and I'm sure it will be an ever-developing tool.

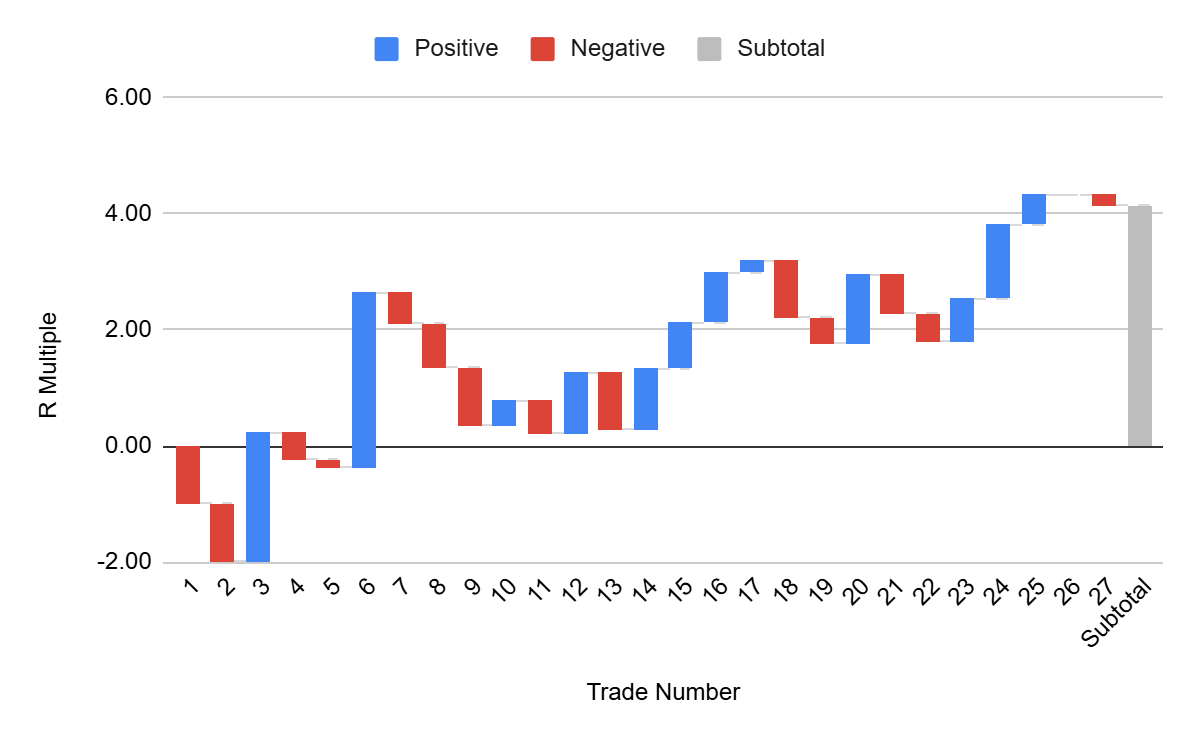

I'll summarise my 2024 trading performance below before touching on a few lessons from the year:

- Final cummulative R-Multiple: +4.148R

- Total number of trades: 27

- Win rate: 48.15%

- Average winner: +1.036R

- Largest winner: +3.025R

- Average loser: -0.666R

- Largest loser: -1R

- Trade expectancy: +0.1535R

With this being my first year of positive expectancy, I’m quite happy with my results, even though I only completed 27 trades. I trade once a week during a 2-hour window in the S&P 500 market session, so my opportunities for capturing potential trades were not necessarily numerous. Ideally, a sample size of 100 trades would likely provide a far more statistically significant result, but it may take me a few years to reach that number. Below is my cumulative R-Multiple progression over the 27 trades:

This is the first time I’ve created a view like the one above. It’s not only quite interesting to observe the progression of win streaks and drawdowns, but it also helps me visualise my trading journey as a whole. One often gets stuck thinking about each trade in isolation and forgets the bigger picture of one's overall trading performance. This graph helps me see that and has proven to be a valuable reminder.

Some thoughts on scaling in: For the first time in my trading career, I attempted scaling in to trades after reading a great book by Tom Hougaard called Best Loser Wins. In the book, he advocates for adding to winning positions, and explains that it is something that successful traders do, so I decided to incorporate it to break the mental barrier of adding more money into the market. This has definitely helped me reduce the fear associated with doing so.

Although my scaled-in trades produced a return of -0.853R, while my initial positions returned +5.001R, I still think it’s a valuable approach. I believe my particular issue lies more with when and how I was scaling in to trades, rather than with the act itself. I’ve since dialled back on this strategy but may I revisit it next year after further analysis.

I often found myself closing my trades manually – based on intuition or my sense of how prices were fluctuating as I watched live – instead of letting them play out. I decided to analyse retrospectively what would have happened if I had left the trades to play out without manual intervention, except in cases where time stops required me to close positions before the markets closed. Aggregating all the trades that I closed manually yielded a result of +0.81R, while letting the same trades play out resulted in +10.61R. Even after subtracting a massive outlier trade of +7R, the outcome still showed a positive result of +3.61R. It seems I’ve been the author of my own demise in that regard. My trade management skills are not where I want them to be yet, and this is definitely something I aim to improve next year. I should be looking for trades to play out regardless of my current feelings, and instead, focus on more technical means for early exits until my intuition is more developed. I suppose the phrase "trust the process" stands out here.

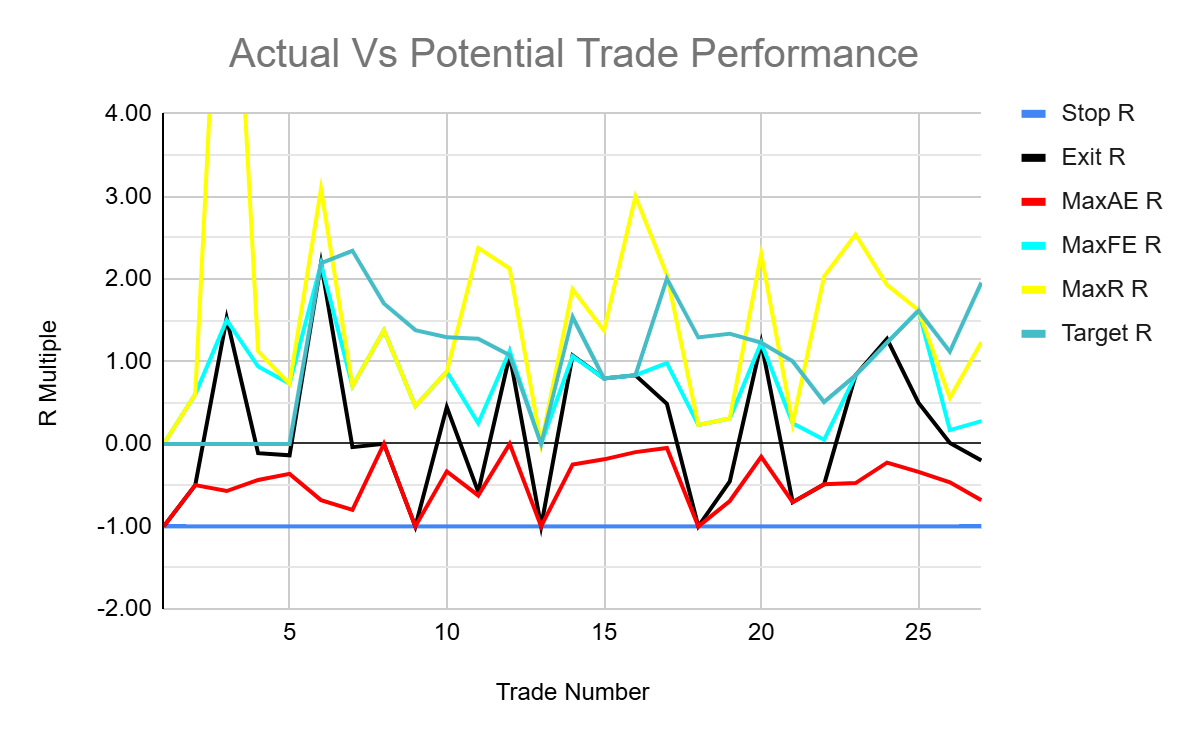

Regarding my most and least profitable setups, it seems that trading reversals of trading ranges and trends has been the most profitable for me, followed by trading pullbacks. My least profitable setups, on the other hand, are trading breakouts. Additionally, something I have been tracking is how price behaves during and after my trade is live. The particular metrics I’m referring to are as follows:

- Maximum adverse excursion (MaxAE): Measures how far the price moved against you before trade exit.

- Maximum favourable excursion (MaxFE): The most profit that could have been extracted while the trade was open.

- Maximum reward (MaxR): Identifies the optimal price point to maximise reward after trade exit.

Graphing these metrics per trade, along with my Stop R-Multiple, Exit R-Multiple, and Target R-Multiple, gives the following result:

Using the graph above to aid visualisation, along with the recorded metrics, helps provide an indication of how your trade parameters are performing in relation to how the market is moving in each trade. Based on the MaxAE line, my stop placement has given most trades sufficient breathing room to perform as needed, while still providing adequate risk barriers in some cases. According to the MaxFE line, I typically extract the most from a trade while it is live. Finally, based on the MaxR, I sometimes leave significant profit on the table compared to my target, particularly with the outlier of Trade 3, which I excluded from the graph for scale reasons.

Given these observations, a definite focus for next year will be optimising my exits. I should aim to be more confident in the market moving further than expected, without being too quick to take my trades off the table and lock in profits. It’s a challenging task, but recording these metrics has definitely given me more confidence in my trade performance relative to price volatility.

One aspect I struggled with at the beginning but have since improved upon as the year progressed was dealing with late entries. I started taking entries at the break of highs and lows of candles, instead of always waiting for the close of a candle above or below these levels. On the 5-minute chart, moves can happen quickly, and if you wait for too much confirmation, you risk missing the move or only catching a suboptimal portion. This is something I’ve noticed while watching price play out live. Once key levels are broken or highs and lows are taken out, price often reacts quickly and begins to establish a new direction.

There are merits in waiting for candles to close to cement patterns and candle formations, thereby establishing a signal. However, entering only on the close past certain levels has proven to be detrimental to how I’ve personally been trading and the signals I’ve been taking.

Finally, an issue I’m still working on is incorrectly reading the market situation. This results in buying or selling at levels too close to zones of support and resistance in market conditions that inhibit the progression of price. I’ve been addressing this by slowing down my pace of analysis and erring on the side of caution when in doubt. Certain market cycles (trends or trading ranges) need to be traded in specific ways, and I’m constantly reminding myself of when to look for which signals, instead of giving in to the flow and pace of the market.

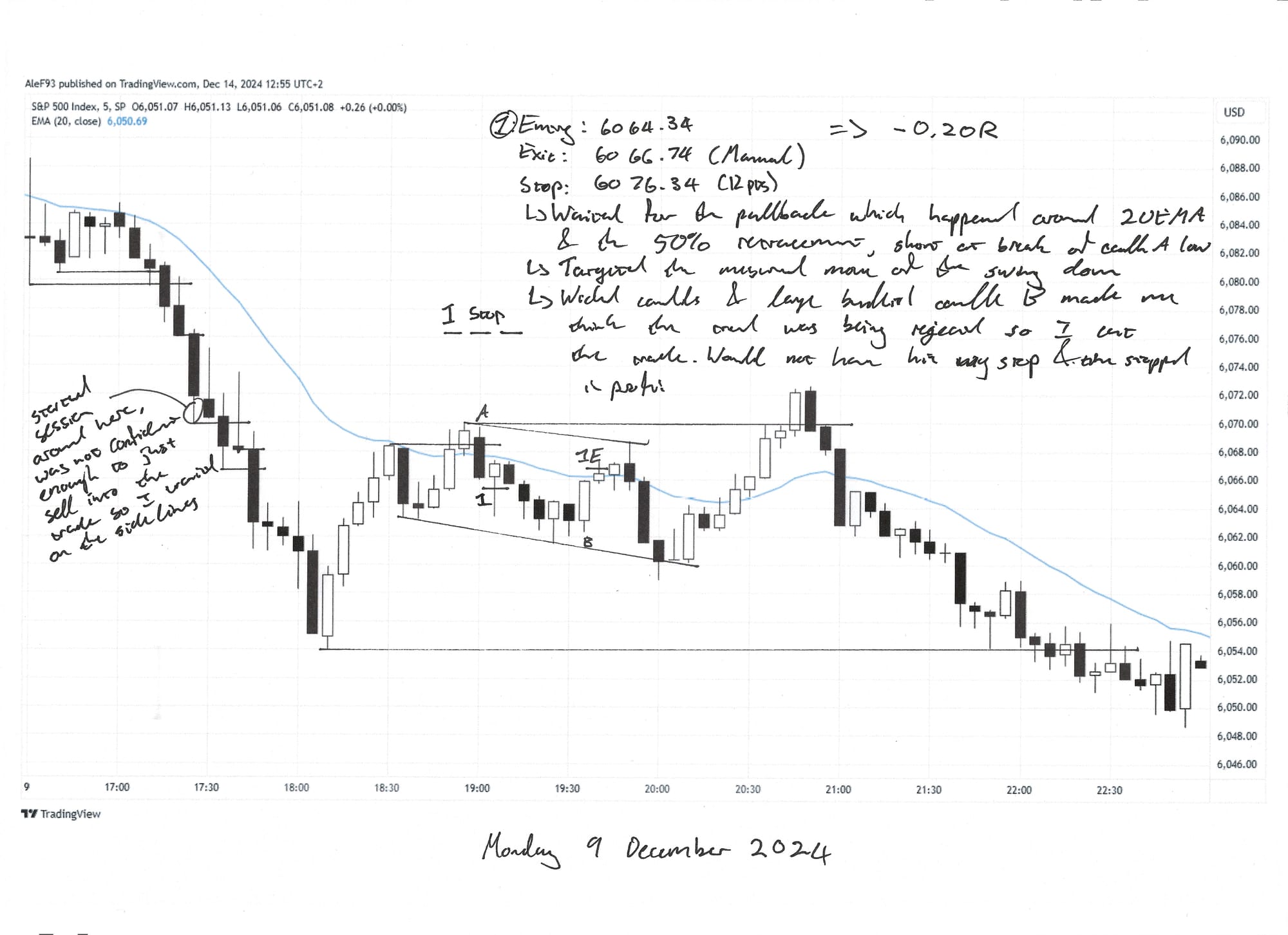

It’s been a refreshing and exciting experience to review and analyse my past trades. I’m grateful for all the data I’ve tracked and continue to look for more to add to my routine analysis. It’s cliché to say, but it’s never too late to start! One thing I’ve found incredibly helpful, besides my digital journals, is keeping track of each trade’s chart, printing it out, and filling in my trades and thoughts by hand. Going through this process on a weekly basis has allowed me to build a collection of physical printouts filled with scribbles and notes. I’ve found it to be quite satisfying and rewarding to build an archive of these hand-scribed charts, and it has substantially helped me visualise my process in relation to how price moved. I’ve added an example of this below:

That brings my 2024 trading review to a close. It’s been a tough yet rewarding journey back into the trading world. I’ve learned a lot this time around, but there is still much more to learn—not only technically but also about how I manage myself when it comes to trading. I’ve identified a few areas to work on in the coming year and look forward to the challenge of improving my process and continuing my journey as a trader.

Until next time :)

~Alessandro