Monthly Recap: August 2024

August 2024 was a tricky month. There were some missed days due to market performance as well as some mismanaged trades which I detail below. I completed four sessions which produced a combined total of -0.83R. Here are this month's trades:

- 5 August 2024

- No trades.

- 12 August 2024

- Trade 1: -0.75R

- Trade 2: -1R

- Trade 3: +0.42R

- 19 August 2024:

- No trades.

- 26 August 2024:

- Trade 4: -0.58R

- Trade 5: +1.08R

On 5 August 2024 some interesting turbulence introduced itself into global markets. A hike in interest rates by the Bank of Japan caused a bout of panic in global markets as a popular Yen "carry trade" began to break down and change its yield mechanics. A carry trade involves borrowing low interest rate currencies with relatively low risk to buy higher yielding assets. This rate differential produces a return while holding the trade and, when combined with leverage, it can multiply said returns substantially with asymmetrically lower risk. The key assumption to the trade is that yield conditions remain relatively stable. That assumption broke down following the most recent interest increase by the Bank of Japan (BoJ).

Given Japan's zero to negative interest rate environment over the past 10 years, the Yen became a popular instrument and produced quite a crowded carry trade. The combination of the BoJ's monetary policy change (affecting an increasingly volatile USD/JPY rate) with a spook in US macroeconomic data the week before, quickly resulted in a perfect storm. Large numbers of traders began to rush out of the carry trade and unwind their positions. This sentiment shift caused an aggressive risk-off wave to flow through the markets which then went diving.

The S&P 500 opened around 3.6% down and traded with 5 minute candles the size of normal trading day ranges. This filled the first 2 hours of the trading day with significant volatility. The volatility was large enough that, given my account size and my required stop risk metrics, my CFD contract size would not have been enough to meet the brokers' minimum for the market size I was trading. As my trade session progressed the volatility rapidly reduced but no opportunities presented themselves based on my criteria. To be honest I also felt a little off given the volatility of the day and uncertainty that was floating around. I felt more comfortable on the side lines, observing, rather than trying to squeeze in a trade just to get involved.

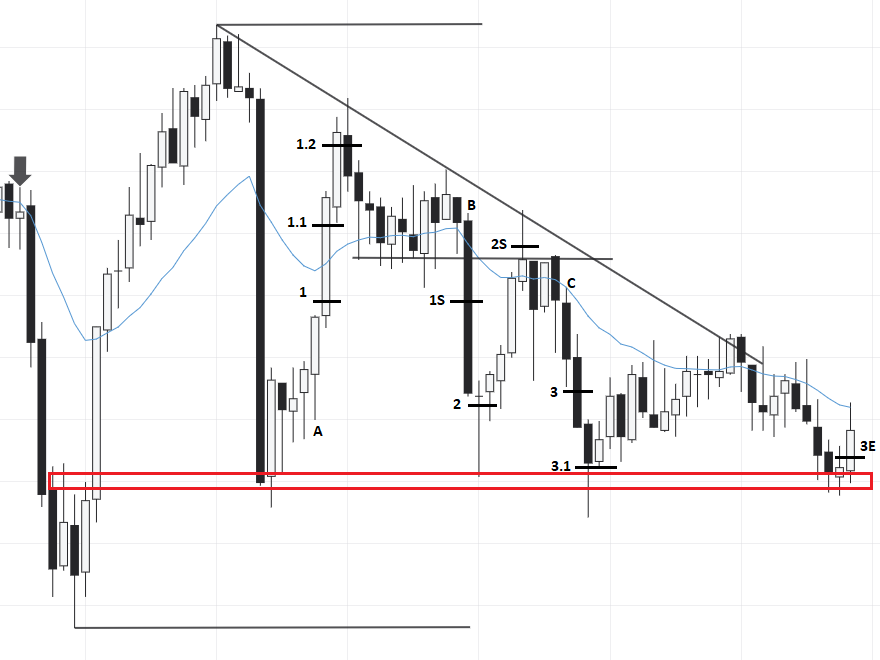

On 12 August things got busier. I took 3 trades as detailed in the image below:

Trade 1 was taken after signal Candle A closed above the highs of the preceding candles. Having watched the candle form, I then saw it punch above the highs with some momentum and close near its highs. After its high was broken I opened a trade long at Position 1. I originally envisioned it taking a trip back up to the highs of the day given the momentum of the earlier move. I scaled in twice at Positions 1.1 and 1.2 respectively. Soon after my second additional position, price reversed then travelled sideways for a bit then proceeding to stop me out. In hindsight my original target may have been too ambitious. I was oblivious to the price action to the left and the congestion with the overlapping candles which formed as the previous move topped out. I also gave away substantial open profits as the move pulled back and moved sideways. I don't currently have an exit rule in my process so I am considering taking this as a sign to begin testing closing positive trades based on adverse price action.

After the large Candle B that stopped out Trade 1 had closed I thought the momentum would continue. As its low was broken I opened a trade short at Position 2. The trade that should not have been... I was completely blind to the swing level that lay ahead (the red box in the figure above was drawn in hindsight and not presented while trading). Being focused on the momentum of the move and a continuation to the lows, I traded short straight into this level. A correct analysis (and not chasing the trade) would have prohibited me from getting involved. This is the second time I've chased a very large breakout candle like this in a trading range and have been stopped out after the move very quickly ran out of steam and reversed to take me out. This is potentially something that I should look out for going forward, and proceed with a bit more caution.

After not learning my lesson that there was a very present swing level that lay in my path I opened another short at Position 3 after signal Candle C. The signal was valid. The market had rejected the pullback after a bounce from the previous breakout level and the 20 EMA (Exponential Moving Average) but my target was still laser-eyed on the lows of the day. The red zone level, however, was in the way. I must have assumed it would be broken, with no confirmation, and the trade would have progressed merrily towards my target at the daily lows. To add more fuel to the fire, I scaled in at 3.1 which sat exactly on the level... My trading session had come to an end for the evening so I left my screen with my stops and targets in place. I came back about 15 minutes before the end of the trading day and manually exited my position. After cutting the trade and taking my last screenshot I had realised I had been trying to trade into a wall with the past two trades (facepalms).

Although I closed Trade 3 with a small profit I was not happy with my performance for the evening. Trade 1 was executed well but exited sub-optimally. However, Trades 2 and 3 should not have been taken given how close the swing support level was. I was blinded by targeting the lows of the day and was not present enough to realise the block that lay ahead. Hindsight is 20-20 vision but there is a lesson to be learned here in always being aware of price action and updating one's views as the trading session unfolds. Ideally I could have targeted the swing level but given my entries and stop sizes, the risk to reward ratios would not have been in my favour.

A week later on Monday 19 August, I took no trades. After some upward trending moves, price congested sideways and then sharply reversed down before slowly moving back up. Even though price was moving higher, there was quite a bit of choppy and congested price action to the left and some higher time frame resistances ahead. I was not confident in getting involved given all the traffic that lay in front of any trade's potential price path.

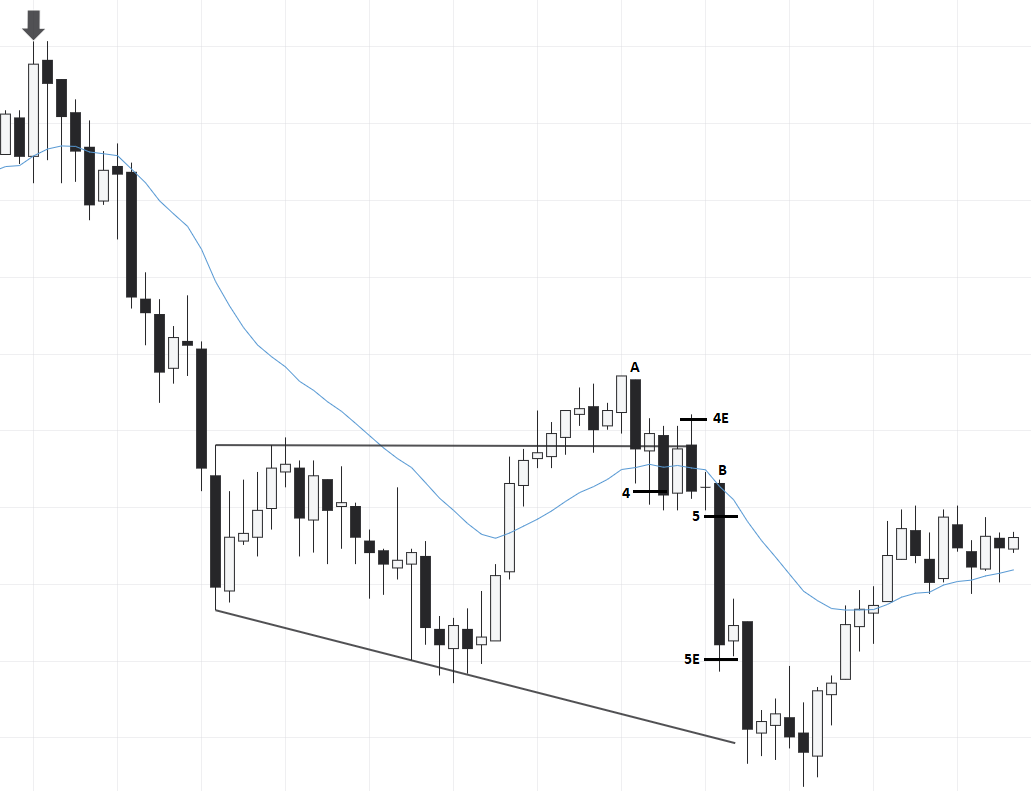

The final session for the month was 26 August. The two trades taken for the day are detailed in the image below:

By the time I started my session, the majority of the day's downward move had taken place and the market was beginning to consolidate sideways. Price made a second bounce on the downward sloping trend line and was heading back to test the highs of the previous swing. Given the bearish momentum of the day I was looking to trade with the trend and take opportunities back down to test the lows. After reaching the horizontal level of the previous swing high, price broke through but was struggling to move higher. Although I trade on the 5 minute timeframe I also sometimes check price action on the 15 and 60 minute chart to see if any higher timeframe levels may come into play. Price was reaching some overheard resistance by driving into the 20 EMA on both these two higher timeframes based on the charts to which I had access.

After the failed move higher, price pulled back and completed a potential failed breakout with signal Candle A. After its lows were broken I opened a trade short at Position 4 with the intention to target the lows of the day. Price originally moved lower then it had a different idea and reversed back up above the 5 minute 20 EMA. For the next few candles it danced around this level but then began to make new candle highs. Given we were above half way to my stop I decided I'd front run my stop being triggered and get out the trade for a smaller loss as price was rejecting the 20 EMA. Soon after that price made a sharp move lower without me. If I had stayed in I would have been able to scale in once and hit my target soon after. It would have been a decent trade. My interpretation of the market and reading the price flow was correct. I just got in the way of my trade and feared my stop being hit so I got out to my detriment. I cared about the outcome which was wrong. I should have been detached. But, as I said in my previous post, trading is a mental game (and the trader does not always win).

Having seen price begin to reverse I was quite annoyed at myself but I decided to move on. If price was going to move downward I was going to wait for confirmation then potentially re-enter with a new short. That was the idea, at least, but pulling the trigger was very difficult. After the lows of the small sideways move that confused me earlier were broken by signal Candle B I opened a second short trade at Position 5. Very soon afterwards my target near the lows of the day was hit with the same candle. Overall the result of the day was +0.5R. This was a positive outcome but there would have been room for considerably more profit had I left Trade 4 alone to do its thing.

So, two of August's days did not produce the right environments for me to trade, and I would have liked more opportunities to get involved. Nevertheless, watching the market play out and price action unfold is still a valuable learning experience. I'm still a long way from refining my craft, how I view market price action and the identification of opportunities that present themselves. Retrospectively analysing charts is easy when the candles to the right have played out. During live price action, however, things become far more challenging.

Until next time :)

~Alessandro