Monthly Recap: June 2024

June 2024 was the first month I started live trading again after a while. Trading on a 5-minute candle chart was something I had tried in the past with limited success here and there, but nothing short of breakeven. It did, however, have a more 'comfortable' feel to it. I didn't really have much of an opportunity to expose myself to these sorts of smaller timeframes, but now I'm making time to make it possible.

For context, I trade the S&P 500 index between 18:00 and 20:00 SAST (give or take 30 minutes on either side), and given the 6-hour time difference, it means I trade the US markets between 12:00 and 14:00 EDT. My trading session takes place on a Monday after my working day is over. It finishes so that I have enough time to have dinner and spend some time with my wife. There's a lot more to life than just trading.

It may not seem like a lot, and it isn't, but it's there to expose me to the flow of the market so that I learn on a regular basis. I may miss many moves and be too late, or I may be just on time or too early, and I may well sit there while nothing happens. That's not the point. The goal is to put in the hours and sit there while I absorb the ebbs and flows of price as it unfolds in the hopes of growing my intuition and improving my price action skills.

Let's move on to the trades. For now, I'm going to use an R system to explain my results where R denotes the capital risked during the trade, i.e., 2R equates to 2 times my risk value being gained and -1R equates to my risk value being lost. I'm going to stick to this method for displaying my results for now, but I might change it in the future. I'll leave more details about my process and how I trade for a later post. Here are the results with a combined total of -0.24R:

- 10 June 2024

- No trades

- 17 June 2024

- Trade 1: -1R

- Trade 2: -1R

- Trade 3: +2.23R

- 24 June 2024:

- Trade 4: -0.47R

On 10 June, the price ranged for the duration of the session with not much movement warranting a reaction. 17 June was a different story. I had the day off, which meant that instead of only being able to trade my 2-hour window, I was able to trade from the open of the US markets and with a bit more time. The fourth candle after the open was large and bearish. It also sold off quite quickly, making a new low for the day and closing below the opening candle. I took this opportunity to go short, but then the price immediately reversed, and within two candles, I was stopped out.

Trade 2 was taken on the close above the high of the day after some consecutive buying pressure. The trade moved in my favour, allowing me to move up my trailing stop and scale in with a new position at half the contract size. This meant that my additional position was exposed to half the risk of my first. After a few candles, I was once again stopped out. Being about -2R down for the day and just getting started meant that mentally I was on a bit of a negative footing.

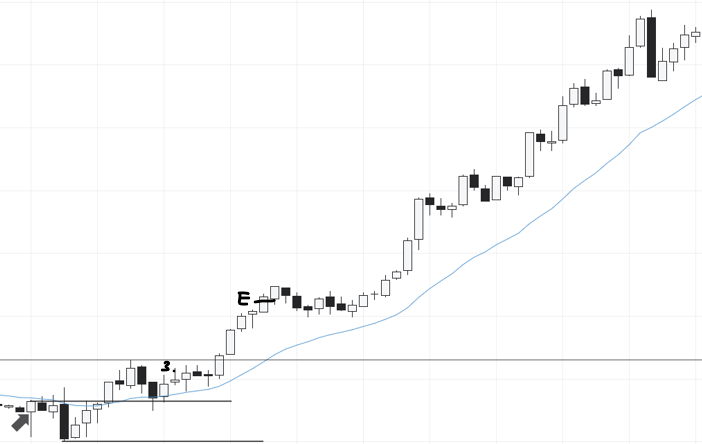

Trade 3 came along, and things started to look optimistic and directional. After trade 2, the price pulled back to the open and rejected it back up. This coincided with a bounce off the 20 EMA (Exponential Moving Average) and a positive candle being formed. I entered my trade once the high of my signal candle had been broken. The price moved in my favour, and I managed to scale in twice while reducing my risk.

As price moved higher I began to get uneasy and uncomfortable. The previous two losses played on my mind and I started questioning whether I should book my profits. Price was starting to struggle to move higher and the impulsive nature of the move got to me. I closed the trade with all three positions in the green. I then decided to end the session for day as I had been sitting there for about 2 hours. I came back later to find this:

Working my trailing stops up with the price, I would have stayed in as the S&P 500 broke higher and made a new all-time highs until the last big bearish candle. With three positions running, I would have been up around four times my result for that trade 😅. Lesson for the day: when we're running a position without a target, let it run irrespective of what's happened in previous trades.

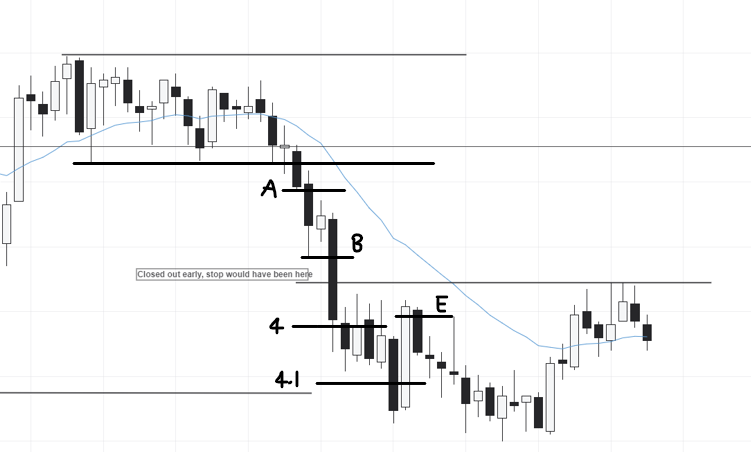

On 24 June 2024, I started the trading session just as the price was consolidating sideways. The prior move from the open was a run-up followed by a pullback. We were potentially setting up for another move higher. I was gearing up to go long, but the opportunity never came. As I watched the price develop, buyers were coming in, but sellers were always taking back control, and lower lows were inching downward. I decided that we would most likely experience a move lower before a move higher, so I started thinking about a short. Unfortunately, my change in sentiment was a bit too late, as I still had a long view and was not fully in touch with what was happening before me. After a big bearish candle, I decided now was the time to get in.

I managed to enter at 4 in the figure above, and as the price moved in my favour, I scaled in with an additional position at 4.1, tightening my stop on the original position. As before, my risk on the trade at 4.1 was half that of 4. Soon after, a large bullish candle formed against me, moving quite close to my stops, so I closed both positions for a loss. Soon afterward, the price continued downward but not much further. It then proceeded to move back up, and both my stops would have been triggered. Closing the trade manually only saved me a small amount. Price did eventually move lower on the day, but I would have been stopped out anyway had I left both trades on. More optimally, the initial position should have been triggered at A or even B on the figure above. At those points, I was still holding on for a move higher and did not notice what was unfolding in front of me, so I joined the move too late. The lesson I'd like to take from this trade is to always be aware and present. Sometimes fixating on a view may blind you from reality, and by the time your mind is aggressively swayed, the move may be mostly over.

That's it for June 2024's monthly recap. Given that I'm starting off, the form and frequency of my trade journals and reviews might change, but I'll start with a monthly format and take it from there.

Until next time :)

~Alessandro